Seamless online processes: Absent are the times when people needed to operate all over tax offices, ready in lines day in and out only to become instructed to return the following day.

These boundaries differ from condition to state and may modify every now and then. It is recommended that you just speak to your GST marketing consultant to know whether or not GST is applicable to you personally or not. How to file nil return in gstr 3b

The launch of GST was also produced complicated by The reality that it necessary a Constitutional Amendment, and as a result, a two-thirds the greater part approval in the Parliament, and also a nod of a lot more than a minimum of 50 % on the states.

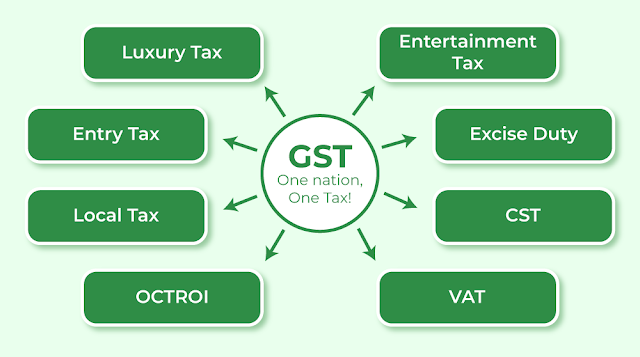

Before we move forward Along with the finer nuances of Indian GST, let's very first recognize The essential idea of GST.

It implies that the GST is levied only at the final desired destination of usage. The principle of spot-based tax is probably the factor that assists in identifying the position of supply.

India has adopted a dual GST technique, whereby the central authorities and condition governments levy GST concurrently. They share a standard tax base.

Our tax advisory expert services assist foreign businesses to remain competitive The principal goal fundamental to the person tax-procedure is to create a single, uniform marketplace across India to facilitate organizational transactions and make domestic products aggressive during the Intercontinental market.

Tax authorities are benefited as this system has reduced time at Test -posts and assists decrease tax evasion.

Accordingly, every registered taxable human being beneath GST is necessary to difficulty a tax Bill, that may be uploaded around the Bill matching process. After the sale and purchase invoices of the taxpayer are actually matched, the ITC might be conferred.

Just after getting criticism for imposing a significant economic hardship on people, the Central Board of Indirect Taxes and Customs issued a series of FAQs justifying the 5% cost around the aforementioned commodities.

A GST registration certificate can be a doc for evidence of staying registered under the GST policies in India. Any organization inside the nation whose turnover exceeds the edge Restrict for GST registration is necessary to have registered under GST.

" If you are reading this information on your computer, or laptop and you are facing an issue your connection is not private frequently, then you can visit with given video on the hyperlink and get the solution as well.

One more thing for you, most of the time we search on the internet that how to earn money online and what are the ways, through which the money should be earned. Let me introduce one thing to you so that you can earn money online at your home. I have created a full course on online earning "Affiliate Marketing". Generally, people search for What is Affiliate Marketing in Hindi. In this video, you will find information about affiliate marketing, And if you want to know the complete course, then you need to visit Affiliate Marketing For Beginners Step By Step. Important thing, it is free for you."

A uniform tax composition: GST has introduced the whole state underneath a single tax regime; it facilitates uniformity in procedures, regulations, and tax fees throughout India.

This can be a 15-digit selection assigned to the central authorities after the taxpayers get hold of registration.

To find out this, it is actually 1st crucial to determine the location with the supplier of the products/ providers and The patron. Location defines whether or website not a combination of SGST and CGST will probably be applicable or only IGST.

0 Comments